Stock market Today: Trump's presidential victory, all reach all-time highs

The stock market today: Trump’s presidential victory has had a profound impact on the US financial markets, sending major indexes like the Dow, Nasdaq, and S&P 500 to record-breaking highs. Investors have responded with optimism, and stocks are reflecting a surge of confidence following Trump’s unexpected victory over Kamala Harris in the 2024 US presidential election. This article will cover how the stock market reacted, the sectors seeing the biggest gains, and what experts predict moving forward.

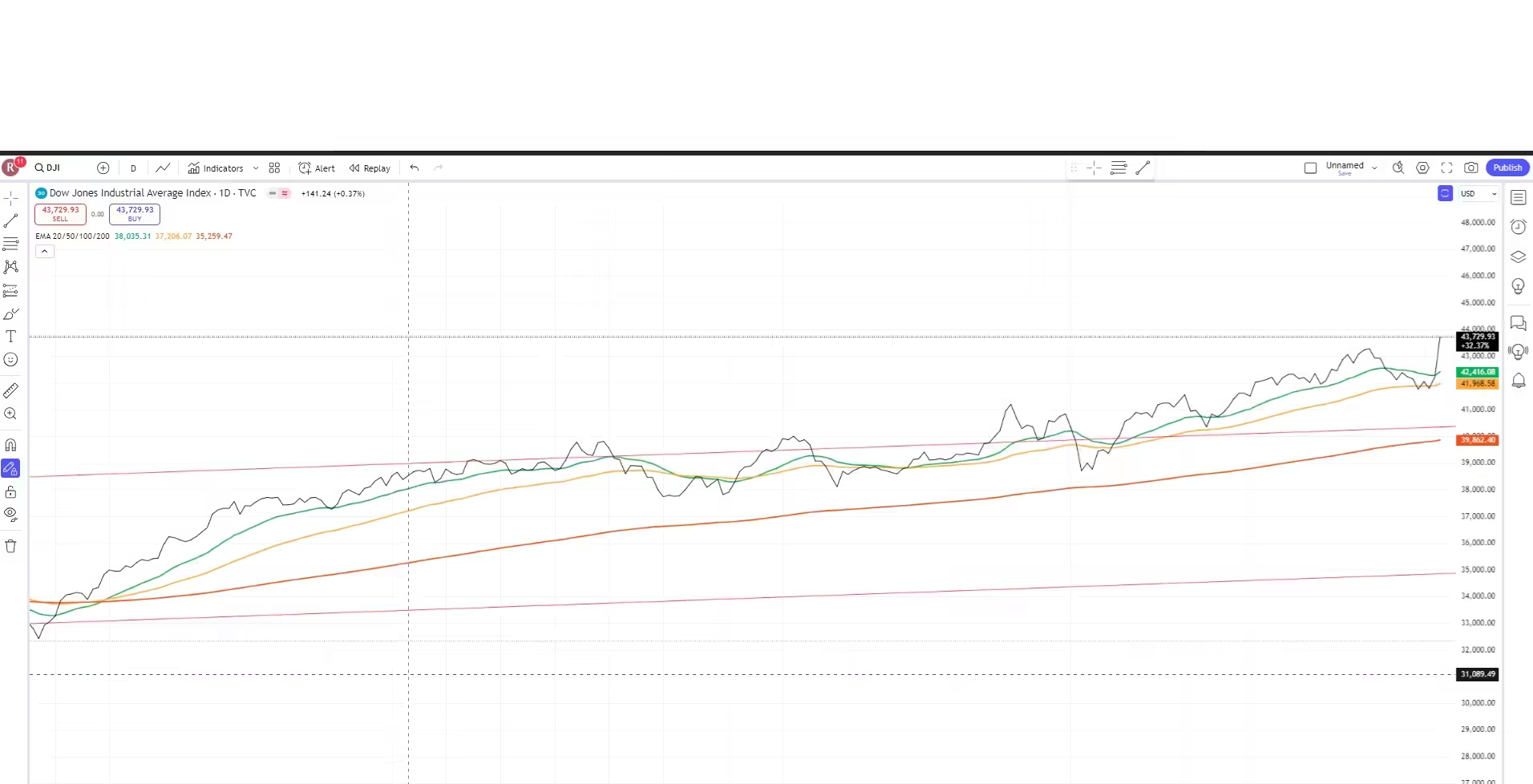

Historic Highs for the Dow, S&P 500, and Nasdaq

The stock market today: Trump’s presidential victory has been marked by a significant rally across all major indexes. On Wednesday, the Dow Jones Industrial Average surged by 3.5%, closing approximately 1,500 points higher and reaching an all-time high. This was the Dow’s strongest day since 2022, signaling investors’ positive sentiment surrounding Trump’s policies and economic vision.

The S&P 500 similarly saw an impressive gain, rising around 2.5% to exceed the 5,900 mark, setting a new record. The tech-heavy Nasdaq Composite followed suit, climbing approximately 2.9% and also reaching an all-time high. This market rally demonstrates how investors are responding to Trump’s election win with strong confidence, leading to robust market growth.

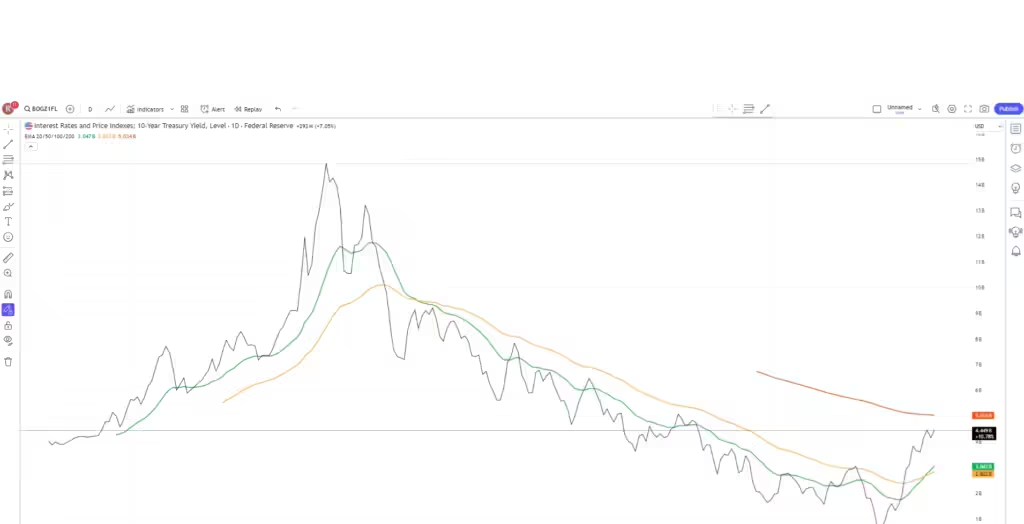

Treasury Yields and Bitcoin Surge

Alongside stock market highs, the 10-year Treasury yield saw an increase of 13 basis points, reaching 4.43%. This spike in Treasury yields reflects investor expectations of economic expansion and a shift toward equities over bonds. Bitcoin also reached new highs, rising sharply as Trump’s win bolstered what some refer to as the “Trump trade,” which includes a boost in traditional markets, cryptocurrency, and the dollar.

The dollar’s value increased, reflecting broader investor confidence in the US economy under Trump’s leadership. As Bitcoin and other cryptocurrencies rally, analysts suggest that Trump’s victory may stimulate both traditional and digital asset markets, creating a dynamic trading environment.

Financial Sector Rallies with Regional Banks Leading

In the stock market today, Trump’s presidential victory has had a notably positive impact on the financial sector, particularly for regional banks. Experts see Trump’s policies as favorable to financial institutions, driving a pre-market rally for the sector. The S&P Regional Banking ETF (KRE) rose by over 11% on Wednesday, while the small-cap Russell 2000 index, which includes many regional banks, surged more than 5%.

Investors are anticipating favorable conditions for the financial sector, with potential deregulation and tax incentives under Trump’s administration. This outlook has driven increased demand for banking stocks, suggesting that financials could continue to perform well in the months ahead.

Tesla and Other Individual Stock Movers

In addition to the financial sector, individual stocks like Tesla have seen substantial gains. Tesla’s shares jumped over 14% on Wednesday, fueled by Elon Musk’s public support and contributions to Trump’s campaign. With Musk’s strong alignment with Trump’s policies and vision, Tesla’s stock rise signals investor confidence in continued support for the electric vehicle industry under the new administration. The stock market today: Trump’s presidential victory is thus having a widespread impact on individual companies beyond the financial sector.

Federal Reserve Expected to Cut Rates

As markets rally, the Federal Reserve’s Open Market Committee (FOMC) began its two-day rate policy meeting on Wednesday. The market widely expects a rate cut announcement on Thursday, with the CME FedWatch Tool indicating a 99% likelihood of a 25 basis point reduction. This anticipated rate cut could further stimulate market activity, creating a favorable environment for stock growth in response to Trump’s win.

With the Federal Reserve likely to lower interest rates, companies could find cheaper borrowing options, which may encourage investment and further drive stock prices upward. The stock market today: Trump’s presidential victory could thus be amplified by the Fed’s policy decisions, creating a potentially prolonged period of market growth.

Implications of a Republican-Controlled Senate

Beyond Trump’s election, the broader political landscape is also shifting as Republicans have flipped the Senate. Control of the House remains undecided and may not be clear for days or even weeks. A Republican Senate could mean fewer obstacles for Trump’s policies, allowing for quicker implementation of initiatives that may benefit key sectors like energy, finance, and defense.

The market’s positive reaction highlights investor enthusiasm over policies that could include tax cuts, deregulation, and infrastructure spending. The stock market today: Trump’s presidential victory suggests that his policy approach, combined with a Republican Senate, could support further economic growth and stability for businesses across various sectors.

Looking Ahead: Market Projections

The stock market today: Trump’s presidential victory underscores an initial wave of investor optimism, but experts suggest a cautious approach as the market adjusts to potential policy shifts. While some analysts are encouraged by Trump’s business-friendly policies, others advise caution, particularly as uncertainties remain regarding international relations and regulatory reforms.

In summary, the stock market today: Trump’s presidential victory has generated record highs across major indexes, with notable gains in the financial sector, strong performance in tech stocks, and a rising Treasury yield. As investors monitor the Federal Reserve’s rate decision and await final election results, the market’s reaction reflects a mix of optimism and strategic positioning for potential growth under Trump’s leadership.

Also, read the other articles:

Nvidia will replace rival chipmaker Intel

1 thought on “Stock Market Today: Trump’s Presidential Victory Leads to Record Highs”