What Are Stocks and How Do They Work

Stocks, often known as firm shares or equities. These assets are known by a variety of names and are an important aspect of many investors’ wealth-building strategies. But that doesn’t imply they’re simple to grasp. To help you get started, we’re going to share (get it?) some information on stocks and how different types may benefit you as an investor.

What exactly are stocks?

Stocks indicate a portion of a company’s ownership. Depending on the stock type, they may also provide shareholders the opportunity to vote on company-related decisions.

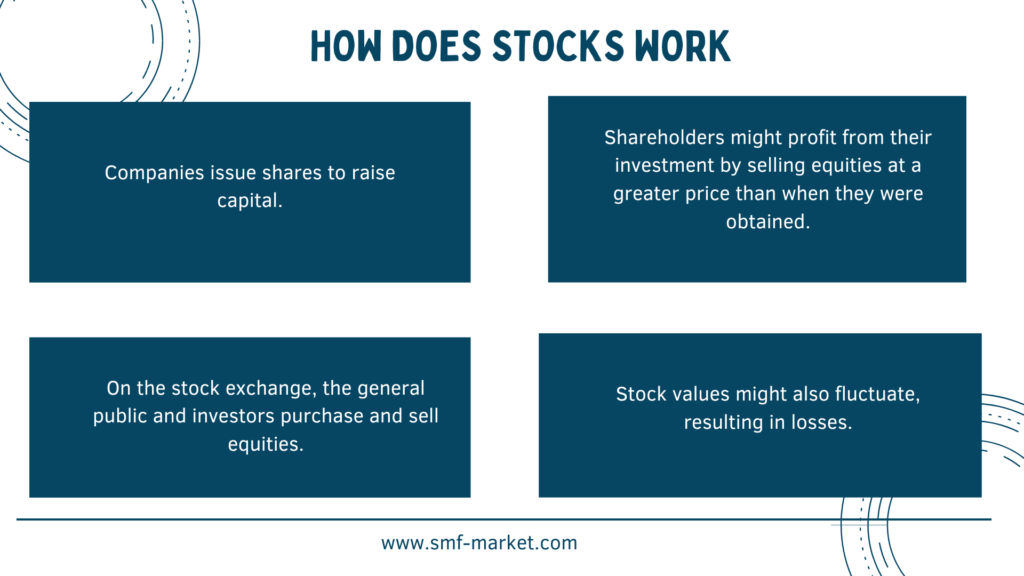

How do stocks function?

What Are Stocks and How Do They Work, In a nutshell, stocks may assist businesses and investors in making money. Money comes from payments received by corporations when investors initially purchase their shares. This capital injection may aid businesses in a variety of ways, including helping to pay down current debt and supporting development plans that cannot or do not wish to be financed with new loans.

Meanwhile, investors may profit from equities in two ways:

Show your gratitude. The value of a company’s stock might rise when it does well financially or becomes more desirable. This enables investors to sell their shares to other investors for a higher price than they paid for them.

Dividends. Certain businesses may opt to distribute a portion of their profits to shareholders in the form of cash payments known as dividends. These are often indicated as a percentage of the value of a share, typically 1% to 3%, and are not guaranteed. Depending on their aims and financial circumstances, businesses may pay them one quarter and miss the following:

What Are Stocks and How Do They Work, Keep in mind that stock prices may not always rise. Share prices can also decrease, leaving investors with equities that are worth, in some cases, much less than what they bought for them. You may help reduce this risk by diversifying your assets and using a method known as dollar-cost averaging, in which you invest a certain amount of money on a regular basis over time. You can afford to acquire more shares while prices are low. When they are high, you will purchase fewer.

What Are Stocks and How Do They Work, However, keep in mind that dollar cost averaging does not guarantee a profit or safeguard against loss in a down market. To make the approach work, you must continue to buy shares during market ups and downs.

Stock classifications

What Are Stocks and How Do They Work, When you think of stocks, you generally think of public stock. It’s the type of stock that can be purchased simply through brokerages and financial applications, and its price changes may be highlighted in the media.

What Are Stocks and How Do They Work, A stock is considered “public” when it is listed on major markets such as the New York Stock Exchange (NYSE) or Nasdaq. This allows ordinary investors to purchase and sell it, but it also exposes corporations to increased regulation. Companies must disclose key components of their finances to assist investors in making educated decisions if they are accessible to average investors, according to the Securities and Exchange Commission (SEC).

What Are Stocks and How Do They Work, Private firms can go public through a variety of methods, including initial public offerings (IPOs), direct listings, and special purpose acquisition corporations (SPACs).

Ownership in a private corporation is represented by private stock. Private stock, unlike public stock, cannot be readily purchased or traded using a standard brokerage account. Typically, every sale of private shares must be approved by the firm.

Private stock is uncommon for the average investor, which might be a positive thing. Private corporations are far less regulated than public companies and have no need to disclose their financial condition to the public, making it difficult for outsiders to assess investment possibilities. However, if you work for a private firm, you may be entitled to private stock as part of your perks or pay package.

The “average share” of equity is common stock. It is the sort of stock that you are most likely to purchase and sell.

What Are Stocks and How Do They Work, Common stock reflects a company’s ownership and provides shareholders with voting rights, allowing them to influence the company’s direction. Its value is mostly derived from price appreciation; however, it may also provide dividends.

If a firm falls bankrupt and must sell its holdings, common shareholders are the last to be reimbursed, behind bondholders, preferred stockholders, and other debt holders.

Preferred stocks are a hybrid of a common stock and a bond. They often provide consistent income through higher-than-average dividend payments, similar to how a bond would with interest payments. Their shares, like ordinary stocks, allow you to own a firm and may increase in value as the company becomes more desirable. Furthermore, “convertible preferred stock” may be changed to common shares by the corporation or, if certain requirements are satisfied, by you.

Preferred equities, unlike regular stocks, do not provide shareholders with voting rights. Another distinction is that they have favored status when a firm goes bankrupt and sells its holdings to pay off its debts and compensate its shareholders.

Growth stocks are shares of firms that investors believe will expand swiftly and rapidly increase in value. Growth stocks are typically associated with smaller, younger firms that have a lot of promise but, at least for the time being, not a lot of profit. Growth stocks do not normally pay dividends since firms may opt to spend more cash in themselves in order to develop quicker.

Growth stocks have substantially higher stock values than you may predict based on their actual earnings. When you acquire one, you’re expecting that the company’s performance will ultimately catch up to the share price’s expectations. There is no assurance that a growing firm will succeed. If it does not, investor confidence may wane, causing prices to fall. As a result, they are riskier investments.

Value stocks are connected with firms that investors believe sell at a discount to their true worth based on profits. They are often larger, more established businesses with good financial records. Some even provide dividends.

If you own a value stock, you hope that the market finally understands that it is inexpensive and that its price rises. If it doesn’t, you can be stuck with a stock that has solid financial fundamentals but never fulfills its full potential.

Income stocks, as opposed to growth or value companies, make their money largely via dividend payments. Growing the value of their stock is an extra advantage.

Income investment can be dangerous since firms might cut or eliminate dividend payments at any moment. Income investors look at a company’s dividend history to see if it has regularly paid or grown its dividend, even in depressed markets, to help reduce that risk.