Introduction

UnitedHealth Group (UNH) and its position in the healthcare industry. (United Health Stock Price)

In the ever-evolving landscape of the healthcare industry, UnitedHealth Group (UNH) stands as a stalwart, its prominence echoing in the corridors of both the health and financial sectors. As we delve into the captivating dynamics of United Health Stock Price, it’s evident that UNH commands a pivotal role. With a robust financial performance and a strategic foothold in healthcare services, the UnitedHealth Group has become synonymous with stability and innovation. Investors keen on navigating the fluctuations of the stock market would be wise to keep a watchful eye on the United Health Stock Price, an instrumental indicator of the company’s health and the industry’s pulse.

Bullish prediction of double-digit returns for UNH stock in 2024.

In the ever-evolving landscape of stock investments, eyes are turning towards UnitedHealth Group (UNH) as analysts predict a bullish trajectory in 2024. The United Health stock price has been the talk of the town, with double-digit returns on the horizon. Market experts foresee robust growth, making UNH an enticing prospect for investors. Amidst the intricacies of healthcare dynamics, the United Health stock stands out with promising signs for substantial returns. As we navigate through the financial seas, it’s hard to ignore the buzz around UnitedHealth Group, and investors are keenly watching for opportunities to capitalize on the bullish prediction of double-digit returns for UNH stock in 2024.

Key factors supporting this prediction.

Forget meme stocks and market volatility – United Health stock price is quietly buzzing with bullish whispers for a reason. This healthcare giant boasts rock-solid financials, riding a wave of aging demographics and booming Medicare Advantage enrollment. Throw in savvy diversification and whispers of policy tailwinds, and you’ve got a recipe for potential double-digit returns in 2024. While a crystal ball isn’t included, the stars seem to be aligning for United Health – keep an eye on this one, because its price might just take flight.

Reasons for Optimism:

Solid Fundamentals:

UNH's strong financial performance, including revenue growth, profitability, and market share

United Health Stock Price watchers have much to cheer about. The healthcare giant has been flexing its financial muscles lately, posting consistently impressive revenue growth, profitability figures that’d make Scrooge McDuck blush, and market share gains that leave competitors scrambling for traction. Analysts are practically lining up to sing UNH’s praises, pointing to these rock-solid financials as major fuel for a potential double-digit United Health Stock Price surge in 2024. Buckle up, healthcare investors, United Health’s ride might just be your ticket to the moon.

UNH's diverse business segments and its focus on high-growth areas like Medicare Advantage.

United Health Stock Price: Fueled by Diversity and Growth Engines. While whispers of recession swirl, one sector seems poised to defy gravity: healthcare. At the heart of this resilience lies UnitedHealth Group (UNH), a behemoth boasting not just one, but a multi-pronged attack on growth. Beyond the traditional insurance game, UNH thrives in lucrative niches like Optum, its data analytics arm, and OptumCare, a network of physician clinics. But the real rocket fuel? Medicare Advantage. This booming segment caters to retirees, a demographic on the rise. With savvy acquisitions and innovation in care delivery, UNH is positioned to ride this wave. So, when analysts murmur “double-digit returns” for United Health Stock Price, it’s not just hype – it’s a testament to a company built for the future of healthcare.

Favorable Market Trends:

Aging population and rising healthcare spending, driving demand for UNH's services.

As the global population ages, the healthcare sector is witnessing a surge in demand, amplifying the need for robust healthcare services. Amidst this trend, investors are eyeing opportunities in stocks that align with the evolving landscape. United Health Stock Price becomes a crucial factor in this scenario, with its trajectory reflecting the healthcare industry’s vitality. As healthcare spending rises to meet the demands of an aging population, United Health’s stock stands out as an attractive investment. Stay informed about United Health Stock Price trends to make strategic investment decisions in this dynamic market, where the intersection of aging demographics and healthcare expenses is reshaping investment landscapes.

Potential policy changes or initiatives that could benefit the healthcare sector.

In the ever-evolving landscape of the healthcare sector, investors keen on the United Health stock price are keeping a watchful eye on potential policy changes and initiatives. With a market driven by regulatory shifts, the United Health stock price could witness substantial growth with upcoming policy reforms. The prospect of increased government support or new healthcare initiatives has the potential to create a positive ripple effect, influencing the United Health stock price positively. Staying informed about these potential changes becomes crucial for investors seeking to make strategic decisions and capitalize on the dynamic nature of the healthcare market.

Analyst Sentiment:

Bullish buzz shrouds United Health Stock Price, with analysts lining up like eager gym rats at a free protein shake bar. Goldman Sachs just slapped a “Buy” label on UNH, predicting a stratospheric price target 20% above current levels. Morgan Stanley echoes the optimism, highlighting United Health’s diversified empire and Medicare Advantage dominance as rocket fuel for growth. But before you dive headfirst into this healthcare haven, remember whispers of caution. Some analysts fret about rising healthcare costs and potential regulatory hiccups, urging a dose of skepticism alongside the hype. United Health Stock Price might be poised for a moonwalk, but keep your helmet on – turbulence could be part of the ride. Do your own research, weigh the risks, and let the data, not just the hype, guide your investment decisions.

Macroeconomic Headwinds:

A shadow hangs over the rosy expectations for United Health stock price: the ominous possibility of an economic downturn. Imagine wallets tightening, discretionary spending slashed, and even healthcare choices becoming cost-conscious. While UNH boasts resilience, even its diverse offerings might not be recession-proof. Rising healthcare costs could further pinch consumers, potentially leading to delayed treatments and lower enrollment, impacting UNH’s bottom line. Regulatory changes, aiming to address these rising costs, also pose a risk. New policies, while addressing long-term concerns, could temporarily disrupt UNH’s established model, adding another layer of uncertainty to the “United Health Stock Price” equation. While UNH remains a stalwart, investors must keep one eye on the economic horizon, for even the sturdiest ship can be buffeted by a financial storm.

Competetion:

United Health Stock Price isn’t the only pulse pounding in the healthcare insurance game. Rival giants like Humana and CVS Aetna aren’t resting on their laurels, constantly innovating and vying for market share. Telehealth and AI-powered care platforms add another layer of intrigue, potentially disrupting traditional models. While these factors create competition, they also indicate a booming healthcare landscape, potentially benefiting the entire industry, including United Health. Keeping a close eye on these disruptors, alongside UNH’s own strategic moves, will be crucial for savvy investors navigating the exciting, volatile path of United Health Stock Price.

Investment Perspective:

In the dynamic landscape of stock investing, the United Health Stock Price continues to be a beacon of potential double-digit returns in 2024. However, success in the market is no fortune teller’s game—it requires diligence. Before diving into United Health, conduct thorough research to grasp the company’s financial health and market dynamics. It’s crucial to understand the risk factors and align your investment with personal tolerance levels. Remember, knowledge is power. While United Health holds promise, exploring alternative investment options within the healthcare sector or the broader market is prudent for a diversified and resilient portfolio. So, delve into the specifics, analyze, and make informed choices for a prosperous investment journey.

Conclusion:

Frequently Asked Question:

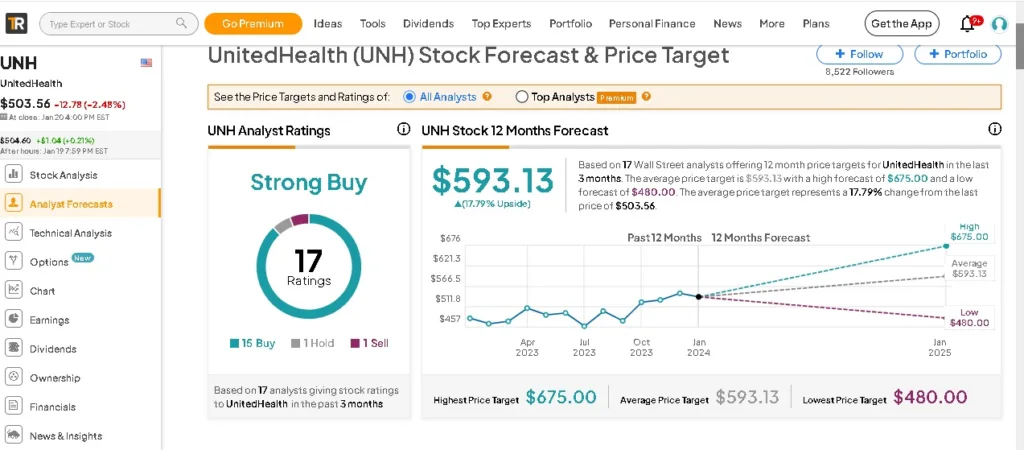

What is UNH’s average 12-month price target, according to analysts?

What is UNH’s upside potential, based on the analysts’ average price target?

Can I see which stocks the top-ranking analysts are rating?

How can I follow the stock ratings of top Wall Street analysts?

Is UNH a Buy, Sell or Hold?

What is UnitedHealth’s price target?

What do analysts say about UnitedHealth?

How can I buy shares of UNH?

Also read the other articles:

quasi in quod sed dolor hic fugiat mollitia est dignissimos unde eius in odio facere reiciendis veritatis. similique corrupti et cum vitae praesentium aut consectetur nemo harum aut illum et. sed qui

odio sit est dolor nihil quasi. ea et aut repellat harum est voluptatem alias. fugiat qui natus est est distinctio quisquam sunt vel numquam corporis occaecati vel ratione. cum cupiditate quis sapient

Your writing is like a breath of fresh air in the often stale world of online content. Your unique perspective and engaging style set you apart from the crowd. Thank you for sharing your talents with us.