Swing Trading Strategies in top 3 Stocks

Certainly! Swing trading involves taking advantage of short- to medium-term price movements in the market. Here are some swing trading strategies:

1. Trend Following:

- Identify a prevailing trend using technical analysis.

- Enter trades in the direction of the trend during pullbacks.

- Use indicators like moving averages to confirm the trend direction.

2. Support and Resistance:

- Identify key support and resistance levels.

- Enter trades when prices bounce off support or resistance.

- Set stop-loss orders just below support or above resistance.

3. Breakout Trading:

- Monitor stocks for consolidation patterns.

- Enter trades when the price breaks above resistance or below support.

- Use volume analysis to confirm breakout validity.

4. Swing Highs and Lows:

- Recognize swing highs and lows on a price chart.

- Enter trades when the price starts to reverse from swing points.

- Set stop-loss orders based on the distance to recent swing points.

5. Moving Average Crossovers:

- Use moving averages with different periods.

- Enter trades when a shorter-term moving average crosses above a longer-term one (bullish crossover) or below (bearish crossover).

- Confirm signals with other technical indicators.

Moving Average Crossovers:

- Use moving averages with different periods.

- Enter trades when a shorter-term moving average crosses above a longer-term one (bullish crossover) or below (bearish crossover).

- Confirm signals with other technical indicators.

RSI and Stochastic Oscillator:

- Utilize these momentum oscillators to identify overbought or oversold conditions.

- Enter trades when the RSI or Stochastic indicates a potential reversal.

- Combine signals with other technical analysis tools.

Candlestick Patterns:

- Learn and recognize candlestick patterns indicating potential reversals.

- Enter trades based on patterns like engulfing, doji, or hammer.

- Combine with other technical analysis for confirmation.

Remember to manage risk by setting stop-loss orders and maintaining a risk-reward ratio. Also, stay informed about market news and events that could impact the stocks you’re trading. Always conduct thorough research before implementing any strategy.

Review the watchlist, the horizons list, and the below-the-200-day moving average list. I hope you had a great Thanksgiving. Let’s get into the swing trading review of the three different stocks that I wanted to focus on. One of them I did participate in and made some money. We have to have all the indicators in a line. When they’re not, they don’t get on The Watchlist. But on The Horizons list, these are stocks that are on the horizon that we believe could be on the watches in the future, but are meeting certain expectations when it comes to the indicators that we use. Let’s look at three stocks on the watch list today, and then we’re going to also look at one on the below 200-day moving average list. Swing Trading Strategies in top 3 Stocks All right, so

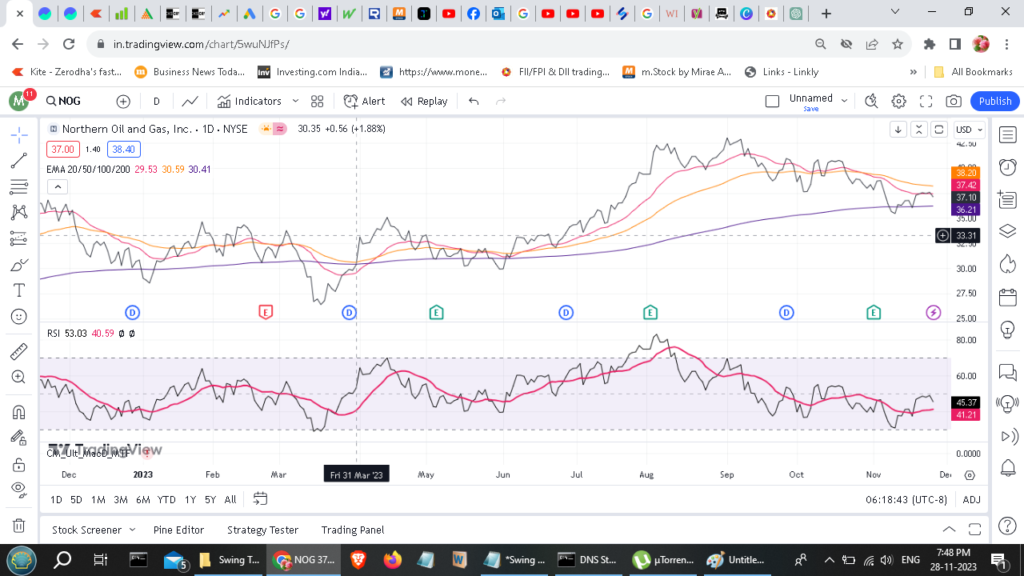

Northern Oil and Gas closed on Friday at 37.28. They went on our list on Monday at 37.22, which is right here. This is the green line that I’m representing. It was quickly off the list; it basically hit resistance at 37.44, and so we were quickly out of it. 16 % gain, not too bad. So if you got 100 shares, you made 16 bucks. Now, it closed on Friday down towards this 20-period moving average, which made the trade on Monday. Even though it was quick, it made some money in this trade. Why isn’t this on the watch list? is the question you’re probably asking. It’s above the 200, but it’s below the 50-period moving average. At the time below the 20-period moving average, but it was also above the nine. It didn’t make the averages that we use. It didn’t meet that criteria. But it looks good to set up of this

20-period moving average and could move higher and exceed 50, which then would hit a lot of the different indicators that we use for stocks

to make the watch list. Swing Trading Strategies in top 3 Stocks

The element of this, the RSI at the time, was about 48. We like it to be above 50. It shows strength above 50. The MACD was in line, the slow stochastic was in line, even though now it’s narrowed here, and that’s something to take into account. We could see Northern Oil and gas hit the watch list in the coming weeks if it breaks above this 50-period moving average. This could be a continuous trade for you if we see continued momentum higher because there’s a pretty nice size gap between the 20 and the 50 moving averages right now. So that could be a trade for the future. Something you need to watch. But we’ll see if Mark puts it back on the watch list this week.

The next let’s tech is Tetra Technologies Incorporated, which is TTI. This was a entry. It went on the list on Monday at $4.74, which was right about here. Even though it dipped lower, it went on the list. We just put it on the list as a Friday night or a Sunday night. It went on the list right around $4.74. It made a move to $47.86. All this happened on Monday. Swing Trading Strategies in top 3 Stocks

If you used the 20-period moving average as your resistance, which is what Mark used, it hit that within the day on Monday, the 12th SEP gain. Now, this is still below the 50, it is still below the 20, it is above the 200, and it is above the 9. Because of this, it’s on the horizons list, not the watch list, where it would have been above all these indicators, along with MACD being positive, RSI being above 50, and the slow stochastic being positive as well. But most of these did not meet criteria, were not met. In the end, it created a 12-cent gain. If you had 100 shares of this, you made 12 bucks. Not too bad. That’s the thing about swing trading: it is about hitting base. You put a handful, but you put base hits together all year long, you’re going to accumulate a pretty nice size gain at the end of the year. This is managing risk. We did not want to take a lot of risk here. We were in and out. We could have ridden this road and played the Hope trade, but in the end we would have ended up back where we were on Friday, which you can see from Monday to Friday. Swing Trading Strategies in top 3 Stocks

Because Thursday was a holiday, Thanksgiving, I hope you had a great time, but this is one of those that you just quickly got in and out. You bought yourself; depending on the number of shares you’re buying, you could have bought Thanksgiving dinner. All right, so this is from the below-200-day moving average list. This is Custom Truck One Source, Inc. Now, this stock is below the 200-day moving average, which is this black line. It is also on Monday of this past week. What was… Monday of this past week was below the 20 or 50-period moving average. It is above the 20-period moving average and above the 9. The big reason this is below the 200-day moving average list is because it’s below the 200-day moving average. This is a higher-risk stock. If you use the 200-day moving average as a long-term indicator, Paul Tudor Jones did during the great financial crisis, S&P dropped below 200-day moving average. He basically liquidated his book of

business, which is multi-billion dollars of assets under management. He uses this as a big indicator. From a short-term or long-term standpoint, this could be a way to manage your overall risk when it comes to managing your overall portfolio. Swing Trading Strategies in top 3 Stocks

In this case, we’re using it as a swing trade indicator. This is going to take more risk, and there’s more risk in this because it’s on a downward trend. It’s below 200. But on Monday, we saw an opportunity for a setup to go higher. Swing Trading Strategies in top 3 Stocks

Custom truck One Source, which is symbol CTOS, went on the list at $5.71. Now, I participated in this stock and I waited to the morning to see if it would drop even further, and I got in at $5.60. Now, stock went down on Tuesday. We wrote it out and ended up closing out the trade on Friday at $5.87. Now, for mine, I got in at $5.60. I sold out at $5.85 because I used the 50-period moving average as my resistance level. I said, if it gets to 5.85,

I’m out, go through the weekend with no risk on the table, or some geopolitical blow-up or something like that. But you can see I stuck

with it. I used my 20-period moving average as my support. They never broke it. Then on Wednesday, I made it pop-up. Then closed out on

Friday. In this case, we closed out at 5.87. For the trade on the below 200-day moving average list, we got a 16 % or 16 cents gain out of it. Swing Trading Strategies in top 3 Stocks

Also read our other articles,

Bitcoin founder Satoshi Nakamoto

1 thought on “Swing Trading Strategies in top 3 Stocks”